All Categories

Featured

Table of Contents

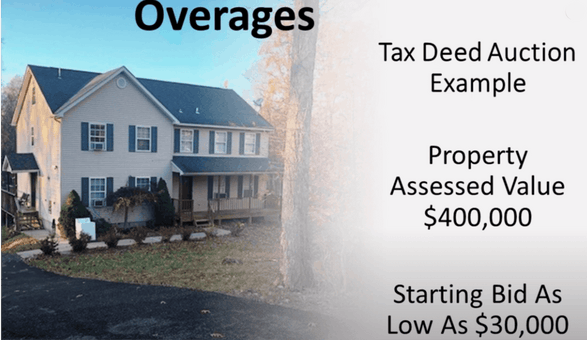

Tax obligation sale overages, the surplus funds that result when a residential or commercial property is cost a tax sale for greater than the owed back taxes, costs, and prices of sale, stand for an alluring opportunity for the original homeowner or their heirs to recoup some value from their shed property. Nonetheless, the procedure of asserting these excess can be complex, stuck in lawful procedures, and vary considerably from one territory to one more.

When a building is marketed at a tax sale, the main goal is to recuperate the unpaid residential or commercial property taxes. Anything over the owed amount, including charges and the cost of the sale, becomes an overage. This excess is essentially cash that needs to rightfully be gone back to the former homeowner, presuming no other liens or claims on the property take priority.

Recouping tax obligation sale overages can without a doubt be challenging, fraught with lawful complexities, administrative difficulties, and possible risks. With correct preparation, awareness, and occasionally professional aid, it is possible to navigate these waters effectively. The trick is to approach the process with a clear understanding of the requirements and a tactical plan for resolving the challenges that might arise.

Homes Lost To Taxes

You can have outstanding investigative powers and a group of researchers, however without recognizing where to search for the cash, and exactly how to obtain it out legally, it's just intriguing info. Now think of for a moment that you had actually a checked, shown 'treasure map' that revealed you just how to locate the cash and exactly how to get it out of the court and right into your account, without worrying about finder laws.

Were the only ones that likewise go after mortgage and HOA repossession overages! Have accessibility to YEARS of data, where you could essentially pick & pick what to take? Make no blunder - this is not a 'obtain rich fast' program (tax sales homes).

Miss tracing is the process of discovering current contact information, such as addresses and contact number, to locate and contact someone. In the past, skip mapping was done by debt collection agency and private detectives to find individuals that where avoiding out on a debt, under investigation, or in problem with the law.

To obtain clear title after a tax action has actually been obtained, please get in touch with a lawyer to start that procedure. The purchaser of a mobile home will certainly be required to license a minimal power of attorney to permit the Area to title the mobile home in your name at the SCDMV in addition to sign up the mobile home with the County.

The regulations requires that an insurance claim be sent. By regulation, we can not approve situations after one year from the taped day, neither can we begin processing of situations up until one year has actually passed from the specific same date. The Tax obligation Collection company will certainly send a referral to the Board of Supervisors relating to the personality of the excess revenues.

The homes offered at the DLT sale are marketed to collect overdue tax obligation obligations owed to Jackson County, MO. If the property costs more than what is owed in tax obligation obligations and fees to the Region after that existing record owners(s) or various other interested occasions, such as, a lien proprietor could request those funds.

Buy Homes For Back Taxes

Please note: This information is for educational features just and is not lawful pointers or a choice to collaborating with lawful advise to represent you. No attorney-client connection or benefit has really been developed as a result of this discussion and no discretion attaches to anything stated below on a public internet site.

The California Profits and Tax Obligations Code, Section 4675, states, in element (paraphrased): Celebrations of Price of interest and their order of concern are: First, lien proprietors of document before the recordation of the tax act to the buyer in the order of their top concern (Unclaimed Tax obligation Sale Overages). Any type of sort of private with title of file to all or any type of area of the residential building prior to the recordation of the tax act to the buyer.

Tax Sale Overages Tax Obligation Public Auction Overages Prior to the choice by the Court, Michigan was among a minority of states that allowed the retention of excess profits from tax-foreclosure sales. list of tax properties for sale. Residential or industrial homeowner that have really lost their property as an outcome of a tax obligation repossession sale currently have a case versus the location for the difference in between the amount of tax commitments owed and the quantity understood at the tax obligation sale by the Region

In the past, miss tracing was done by financial debt collector and private investigators to locate individuals that where preventing a financial obligation, under examination, or in issue with the regulation.

Who is needed to file tax overages manual pdf? All people who are required to submit a federal income tax obligation return are also needed to file a tax excess manual.

Purchase Delinquent Property Tax

Depending on their filing standing and earnings degree, some individuals may be needed to submit a state income tax obligation return. The manual can be located on the Irs (INTERNAL REVENUE SERVICE) website. Just how to submit tax excess hands-on pdf? 1. Download and install the appropriate PDF form for submitting your taxes.

Adhering to the guidelines on the form, complete all the fields that are pertinent to your tax obligation situation. Make certain to supply exact details and double check it for accuracy. 3. When you come to the section on declare tax excess, make certain to give all the info needed.

Submit the type to the pertinent tax obligation authority. What is tax excess hands-on pdf? A tax overages manual PDF is a document or overview that provides info and instructions on exactly how to locate, gather, and insurance claim tax excess.

Homes For Sale Back Taxes

The excess quantity is typically refunded to the owner, and the guidebook provides advice on the procedure and treatments entailed in claiming these reimbursements. What is the function of tax excess hand-operated pdf? The purpose of a tax obligation excess manual PDF is to give details and assistance pertaining to tax obligation overages.

2. Tax Year: The specific year for which the overage is being reported. 3. Amount of Overpayment: The total quantity of overpayment or excess tax obligation paid by the taxpayer. 4. Resource of Overpayment: The factor or resource of the overpayment, such as excess tax obligation withholding, estimated tax payments, or any type of various other appropriate resource.

Refund Request: If the taxpayer is asking for a reimbursement of the overpayment, they need to suggest the total up to be refunded and the recommended approach of refund (e.g., direct deposit, paper check). 6. Supporting Records: Any type of relevant supporting records, such as W-2 kinds, 1099 forms, or other tax-related invoices, that confirm the overpayment and justify the reimbursement request.

Trademark and Day: The taxpayer must sign and date the paper to certify the precision of the info given. It is essential to note that this information is common and may not cover all the particular demands or variants in different regions. Always consult the appropriate tax authorities or seek advice from a tax expert for precise and current details pertaining to tax obligation excess reporting.

Latest Posts

2020 Delinquent Tax Sale

Government Tax Properties For Sale

Homes For Sale Due To Back Taxes